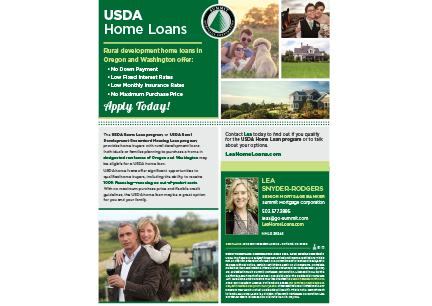

Lea Snyder-Rodgers

SENIOR MORTGAGE BANKER

Lea Home Loans NMLS 39346

C: 503.577.3895

leas@go-summit.com

Summit Mortgage Corporation | NMLS 3236

Meet Lea Snyder-Rogers

I graduated from Oregon State University in 1997 and started in the mortgage lending industry in 1998. I have a wealth of knowledge on a wide range of financing options. I pride myself on exceptional customer service and I’m committed to excellence on every level. If you’re looking for an Oregon mortgage, then you’ve come to the right place!

I take pride in offering each of my client’s excellent customer service. Lea Home Loans has assembled one of the strongest teams in the Oregon mortgage banking industry, allowing us to provide outstanding customer service and programs. We are located in Portland, Oregon and offer financing throughout the states of Oregon and Washington.

With over 16 years of industry experience, we can help you with your mortgage lending needs! Whether you are purchasing your first home or your tenth rental property, we are committed to explaining all of the available options and ensuring a smooth, timely closing.

Summit Mortgage Corporation is a DIRECT LENDER. This means we close loans in our name, have in-house underwriting and funding, along with very competitive terms and fees. Contact me today and see what sets us apart from other mortgage banks.

Purchasing A Home

Your dream home is at your fingertips. Whether you’re buying a home for the first time or looking for the perfect vacation home, we’ll help find the financing option that’s right for you.

Need To Refinance?

Saving money is good. Refinancing can help you obtain a lower interest rate, leverage your home’s equity, or simply lower your monthly payments. Let’s find a refinance solution and make it happen! Capitalize on these low rates.

Niche Products

We offer a wide array of niche products, as well as mortgage loans for manufactured and modular homes, properties with large acreage, Washington State bond programs, low-interest second mortgages, future income programs, extended lock options, and more.

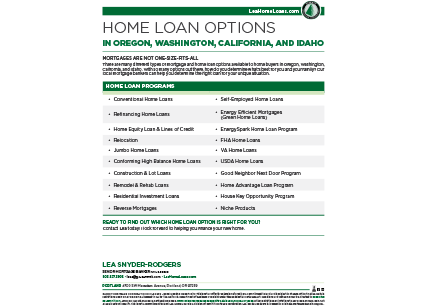

Loan Options

Purchasing or Refinancing in Oregon or Washington?

Look no further. I have a wealth of knowledge on a wide range of financing options. Here are just some of the home loan programs I specialize in:

- Conventional Home Loans

- Fixed & Adjustable Rate Mortgages

- Refinancing Home Loans

- Relocation

- Jumbo Home Loans

- Conforming High Balance Home Loans

- Construction & Lot Loans

- Remodel & Rehab Loans

- Residential Investment Loans

- Reverse Mortgages

- Self-Employed Home Loans

- Energy Efficient Mortgages (Green Home Loans)

- EnergySpark Home Loan Program

- FHA Home Loans

- VA Home Loans

- USDA Home Loans

- Good Neighbor Next Door Program

- Home Advantage Loan Program

- House Key Opportunity Loan Program

- Niche Products

Learn more about available loan options and apply today!

Team

Kim Pepper

Senior Loan Processor

O: 503.546.1273 | F: 360.567.2947

kimp@go-summit.com

Jake Johnson

Licensed Transaction Coordinator

NMLS 2061408

O: 503.459.0087 | F: 503.961.8113

jakej@go-summit.com

Testimonials

I really appreciated Lea Snyder’s approach – she kept me fully informed every step of the way, took extra steps that made the process easier for me, and dealt with my errors with patience and good humor. It was a good experience.

Amazing experience and happy to have worked with the team.

Lea Snyder was fantastic… our loan was done quicker than we thought it would be and the customer service was beyone expectations… it was so great that I referred some of my co-workers. That says a lot as I do not refer easily. Thank you again Lea.